Welcome to Equity Key Accounting, where expert financial solutions meet precision.

Rely on us to handle your finances with unmatched accuracy and reliability, all while focusing on driving your growth.

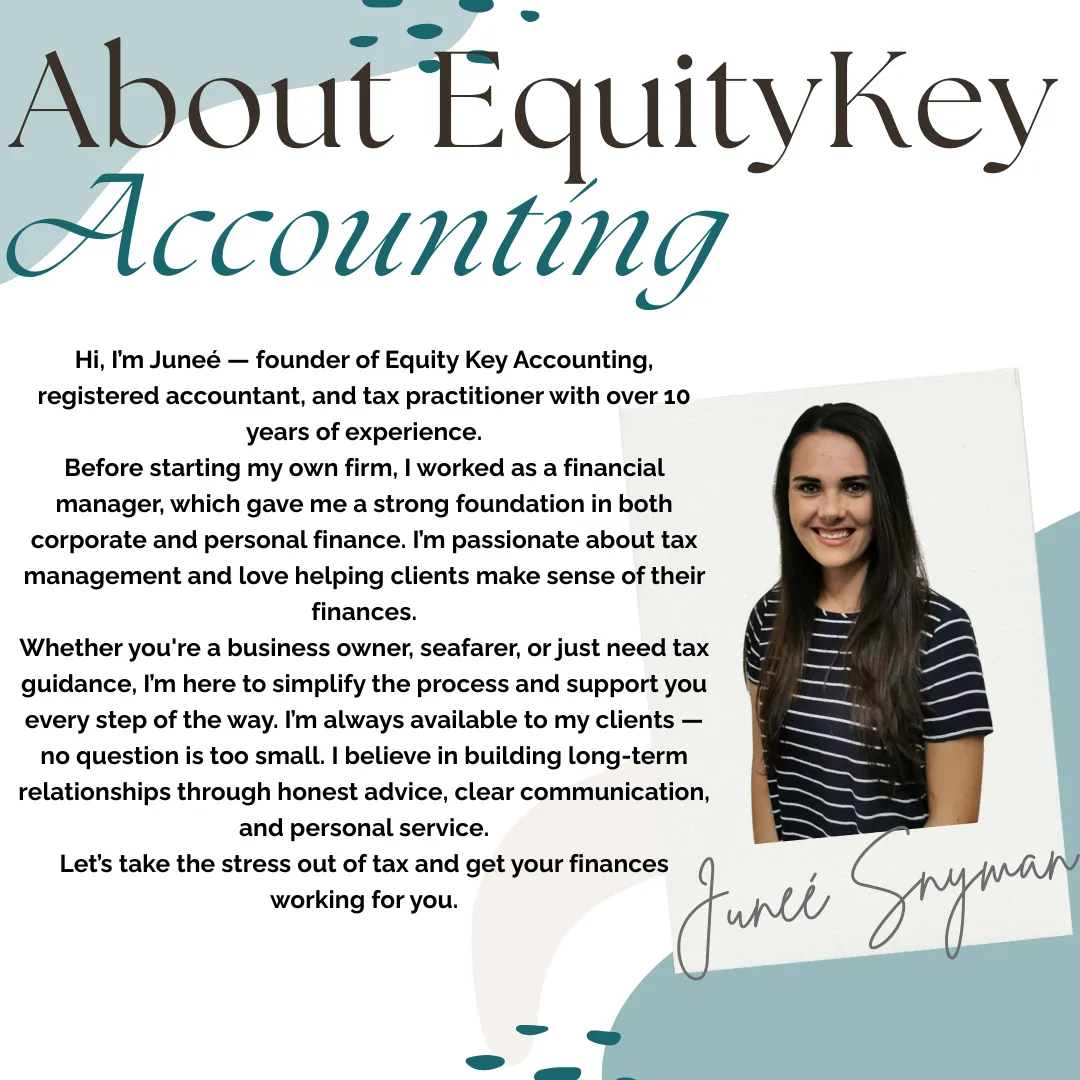

Who Are We?

Supported by a team of Professional Accountants.

Our team of Professional Accountants is dedicated to providing tailored financial solutions and strategic advice to help businesses thrive. Discover how we can support your success today

Our Mission?

We will provide you with proof of your monthly compliance with SARS and CIPC.

Our mission is to empower businesses with expert financial management and strategic insights that enhance financial performance and support growth. We aim to simplify your accounting processes, improve financial reporting, and ensure compliance, all while helping you achieve your financial objectives.

Our Approach?

At Equity Key Accounting, we take a personalised approach to every client relationship.

We start by understanding your unique business needs and goals, which allows us to develop tailored solutions that align with your financial objectives.

Our commitment to excellence and attention to detail ensures that you receive the highest level of service and support.

Our Services

Accounting

Services

Tap into our expertise to gain deeper financial insights and make smart, strategic decisions that drive your business forward.

Tax

Services

Whether you're an individual or a small business, we offer tailored tax strategies with expert precision and unwavering attention to detail.

Secretarial

Services

From business registration to annual returns and beneficial ownership filings, we ensure full compliance—so you can focus on growing your business.

Bookkeeping

Services

Our detailed, professional bookkeeping gives you the clarity you need to make informed decisions and keep your business on track.

Payroll

Services

Let us handle your payroll—from PAYE calculations to payslips—so you can rest easy knowing your team is taken care of.

Accounting

Software

We work with a wide range of accounting software and are proud Xero partners—ensuring seamless integration and top-tier service.

Choose Your Accounting Package

Affordable Accounting Services for Your Peace of Mind

Compliance Package

From R 1125 monthly

This package is perfect for start up companies to ensure compliance. This package includes: CIPC compliancy ( AR & BO), Bookkeeping, Financial Statements and Income Tax submissions.

Basic Package

From R 1 435 monthly

This package provides essential financial services tailored for entrepreneurs and small businesses, ensuring compliancy with CIPC, Bookkeeping, Financial Statements, VAT Calculation & submissions or PAYE Calculations & submissions.

Premium Package

From R 1 635 monthly

This package provides essential financial services tailored for entrepreneurs and small businesses, ensuring compliancy with CIPC, Bookkeeping, Financial Statements, VAT Calculation & submissions and PAYE Calculations & submissions.

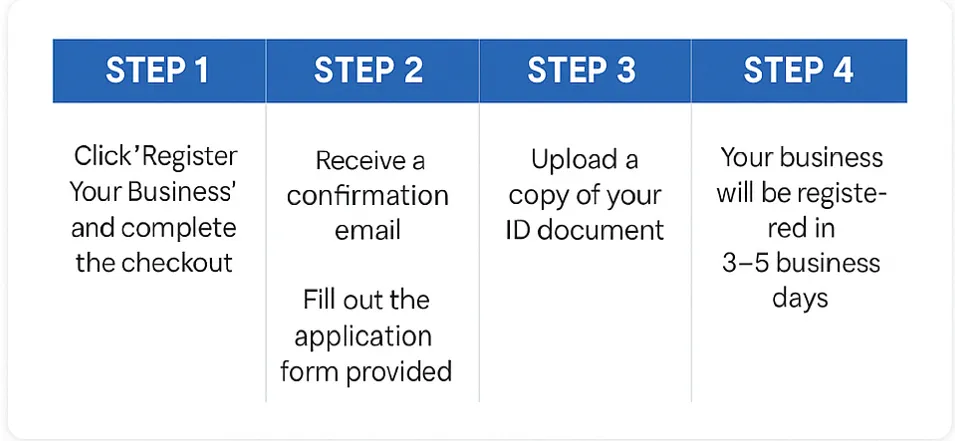

Company Registration

Thousands of businesses trust Equity Key Accounting to register their companies with confidence. Incorporating your business not only offers legal protection and enhances your credibility but also opens doors to funding and payment platforms. Let Equity Key Accounting help you stand out and start strong.

Individual Income Tax

Online Income Tax Help

Getting your tax return submitted has never been easier. Our simple 3-day process keeps everything quick and hassle-free:

1️⃣ Fill in the online form to get started.

2️⃣ Receive your invoice and approve the eFiling profile transfer.

3️⃣ We calculate your tax the next day and send it to you for approval.

4️⃣ Approve your calculation and we submit your return the following day.

✔ Quick. ✔ Professional. ✔ Stress-free.

👉 Click below to start your submission today!

YACHTING SPECIFIC TAX SERVICE

Tax Services Tailored for South African Yacht Crew

Let's make sure you pay the minimum tax - LEGALLY!

Full-Service + Tracking Option

R449pm

We handle everything—start to finish.

Monthly tracking of your sea days and travel

Help with payslips and travel diary submissions

Tax return preparation and submission

SARS correspondence handled for you

Foreign income exemption applied accurately

Best for:

Busy crew members who want stress-free, hands-on support all year round.

Full-Service Tax Option

R349pm

You send the paperwork—we do the rest.

Submit your payslips, passport stamps, and travel records when requested

We prepare and file your tax return based on the information you provide

Foreign income exemption checked and applied if applicable

SARS queries handled by us

Best for:

Crew members who keep their own records but prefer a professional to handle the technical work.

Self-Managed Lite Option

R249pm

You manage the tracking—we handle the filing.

We give you an Excel tracker (submit it twice a year)

Submit your passport copies and provisional figures

Confirm your time at sea (e.g., “I confirm 183+ days abroad, 60+ continuous”)

We submit your tax return using your information

Best for:

Clients confident managing their own records with minimal assistance.

Read More:

We offer specialised tax services for South African yacht crew, designed to ensure compliance with SARS while minimising your tax liability through correct use of the foreign income exemption. Clients can choose between two flexible packages: our Full-Service Tracking option, where we handle everything from monthly tracking and exemption checks to return submission and SARS correspondence; or our Self-Managed Lite option, where you manage your own tracking using our Excel template and submit it twice a year along with passport copies and a simple declaration. Whichever package you choose, we’ll ensure your return is accurate, compliant, and tailored to your time at sea.

Tax Registration

If you don’t have a tax number yet, we’ll handle your SARS registration from start to finish—ensuring your details are correctly captured and linked to your income as a yacht crew member.

Annual Tax Returns

We prepare and submit your full annual tax return, applying the Section 10(1)(o)(ii) foreign income exemption (up to

R1.25million) to legally reduce or eliminate your tax liability—provided you meet the requirements.

Exemption Review

Before filing, we carefully review your employment contract, payslips, and travel records to ensure you qualify for the exemption, and that it’s applied accurately and defensibly.

Monthly Tracking

For full-service clients, we provide a simple monthly form where you upload your payslip and note your travel movements. This helps us calculate qualifying days abroad and ensures you stay

compliant and audit-ready

year-round.

SARS Support

We handle all SARS correspondence on your behalf, including assessments, verifications, and objections—giving you peace of mind while we manage the admin.

Tax Planning

Need help understanding how your South African assets, future plans, or income changes affect your tax position? We offer strategic advice tailored to your unique situation.

All you need to know about SARS & Yachting

Your Foreign Income & SARS – Know Where You Stand

If you're a South African working on a yacht abroad, your lifestyle might feel far removed from home—but SARS hasn’t forgotten about you.

As a seafarer with South African tax residency or local assets (like property, shares, or even a bank account), you’re still legally required to declare your worldwide income—even if you're never paid in rands.

Many yacht crew mistakenly believe they don’t need to file tax returns because they work offshore. However, failing to comply can lead to penalties or issues later on—especially if you plan to return to South Africa, invest locally, or buy property.

The R1.25 Million Foreign Income Exemption – Do You Qualify?

South African tax law allows for up to R1.25 million of foreign income to be exempt from local tax, under Section 10(1)(o)(ii)—but only if you meet the following three key conditions:

You are employed under a formal employment contract (not self-employed or freelance);

You work outside South Africa;

You spend more than 183 days overseas in a 12-month period, with at least 60 of those days being continuous.

If you meet these criteria, you can legally exclude up to R1.25 million of your foreign salary from your South African taxable income. If you earn more than that, the balance is taxed in SA (unless you apply for further relief).

Why It Matters?

Even if you’re being paid in euros, USD, or pounds, SARS still requires annual tax submissions from South African residents. And if you're not registered, or not filing, you're at risk—especially if you have financial interests in the country. By correctly claiming the foreign income exemption and staying compliant, you can protect your earnings, avoid penalties, and plan with peace of mind.

Our Service explained:

At Equity Key Accounting, we offer specialised tax services tailored for South African yacht crew. Our goal is to help you stay compliant with SARS while legally minimising your tax through the correct application of the R1.25 million foreign income exemption. We handle everything—from SARS tax registration and full annual return submissions to monthly tracking of your payslips and travel, ensuring you're always audit-ready. Our team evaluates your time at sea and employment structure to confirm your exemption eligibility, and we manage all SARS correspondence, assessments, and objections on your behalf. For crew with South African assets or future plans to return home, we also provide personalised tax planning and advice. With us, you stay compliant and confident—wherever the ocean takes you.

At Equity Key, we excel in precise financial management tailored to your needs. Contact us today for expert assistance.